Option 1: Manual Verification

Client uploads images and/or documents for a firm to verify manually.

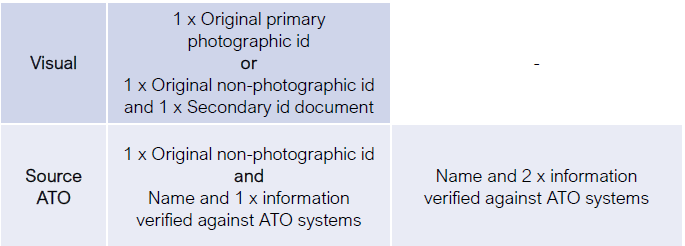

Send a request to the client to provide either visual identification or identification via documents sourced from the ATO

Clients can submit one of the following sets of ID:

- 1 x original primary photographic ID

- 1 x original non-photographic ID and 1 x secondary ID document

- 1 x original non-photographic ID and name and 1 x information verified against ATO systems

- name and 2 x information verified against ATO systems

Once received it is up to the firm to verify the authenticity of these documents and apply reasonable care in carrying out the minimum care outlined by the ATO.

Click here to read more about manual client verification on our blog.

Option 2: DVS (Document Verification Service) via Stripe

Powered by Stripe’s identification tool, Seamlss helps firms keep critical data organised and protected, while also providing a convenient way for customers to supply sensitive information.

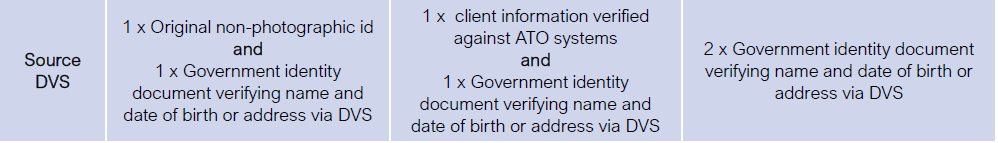

Clients can submit one of the following sets of ID:

- 1 x original non-photographic ID and 1 x government identity document verifying name and date of birth or address via DVS

- 1 x client information verified against ATO systems and 1 x government identity document verifying name and date of birth or address via DVS

- 2 x government identity documents verifying name and date of birth or address via DVS

The fee of $10 per completed Stripe Identity verification request, payable via month-to-month invoices, will give you confidence that documents have been verified against government databases.

Click here to read more about using Stripe Identity on our blog

For more help on how to request identification documents from clients, click here