Verifying your clients when onboarding them just makes sense. Seamlss has been designed to allow clients to easily onboard and verify without any separate apps or tools required.

Doing a separate verification process or transaction when onboarding can create a new separate task for the team to miss or mix up. Seamlss allows firms to collect the user’s data, and permission to engage and onboard with the ATO. These are all important to allow your team to get on with the job, and know all steps of the onboarding process are completed before any work begins.

Key to security

Seamlss is ensuring clients and firms all use 2FA to protect personal data. All data is hosted in Australia, using bank-level encryption key management. This means that the data is encrypted at rest and in transit when being used by clients and firms. We also use validators to ensure TFNs are correct when clients enter them so you don’t have to.

The Process

The ATO recognises that more registered tax practitioners are adopting online practices with minimal agent-client face-to-face or even physical contact. Seamlss allows firms to get started with clients before the first meeting.

Seamlss verification method means firms adopt the following.

Step 1

Ensure that client details match ATO records (full name, TFN, DOB), this is all collected when onboarding clients.

Step 2

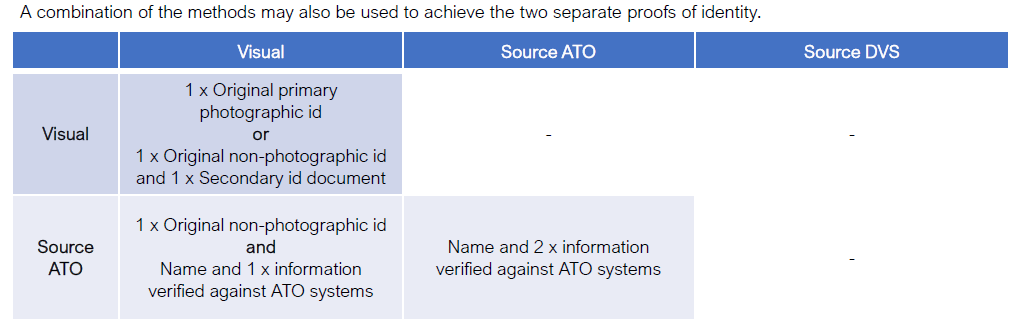

Check and verify any 2 additional pieces of information using a combination of verification methods from the table below.

Combination of verification methods

The key to ensuring you remain compliant is to limit using data that could easily be identified through social media, such as a residential address, email address, phone number, or employer ABN.

Table of combination methods

Visual methods

Step 1

Enable Seamlss to get a signed engagement letter as an electronic authority for the firm to act on a client’s behalf and to link their client record using their TFN and DOB, or ABN and name for the ATO portal.

Step 2

The team can check and sight your client’s identity documents.

If a primary photographic ID has been provided, ensure the photo matches the person. Confirm visually the details on the documents match those given by your clients such as name, gender, address, and DOB.

Step 3

Once the client is linked in the ATO, the team can confirm your client’s name, TFN or ABN, address or DOB matches ATO records.

When undertaking client verification checks:

-

- do not confirm or deny specific information from the ATO client record

-

- do not give the client any private information

-

- do not share or confirm pre-fill information.

Source ATO methods

Step 1

Enable Seamlss to get a signed engagement letter as an electronic authority for the firm to act on a client’s behalf and to link their client record using their TFN and DOB, or ABN and name for the ATO portal.

Step 2

Once linked, verify the name your client gave matches the name on ATO systems.

Step 3

Verify, at minimum, 2 further pieces of information against ATO systems. You can only use the following information:

-

- bank account details

-

- details from an ATO-generated notice or lodged return that you can confirm on ATO systems

-

- notice of assessment sequence number or reference number

-

- activity statement document identification number

-

- correspondence reference number

-

- ATO account details

-

- recent account balance – information provided by the client can be lost, typically plus or minus 5% (a nil balance value is not acceptable)

-

- amount of any refund, payment, or interest (general interest charge or shortfall interest charge) imposed – information provided by the client can be close, typically plus or minus 5%

-

- amount and frequency of a payment plan

-

- pay as you go instalment amount or rate

-

- gross payment or tax withheld from an income statement

-

- reportable super contributions

-

- HELP balance (a nil balance value is not acceptable)

-

- information specific to the client, including

-

- name and membership number of the super fund

-

- private health insurance membership number.

When undertaking client verification checks:

-

- do not verify the same pieces of information for all clients (instead, randomise requests for identity verification purposes)

-

- do not ask for multiple client details from the same source or information that could be obtained from social media

-

- do not confirm or deny responses to client verification questions. Instead, complete a series of questions and provide a final response at the end such as ‘I am unable to verify your information at this stage.’

-

- do not give the client any private information

-

- do not share or confirm pre-fill information.