Throughout the form you will see help icons that you can click on to see help on how to answer particular questions.

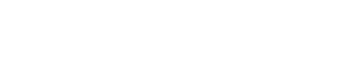

General Information #

When you start typing in the occupation field, a drop down menu will appear with pre-filled occupation titles.

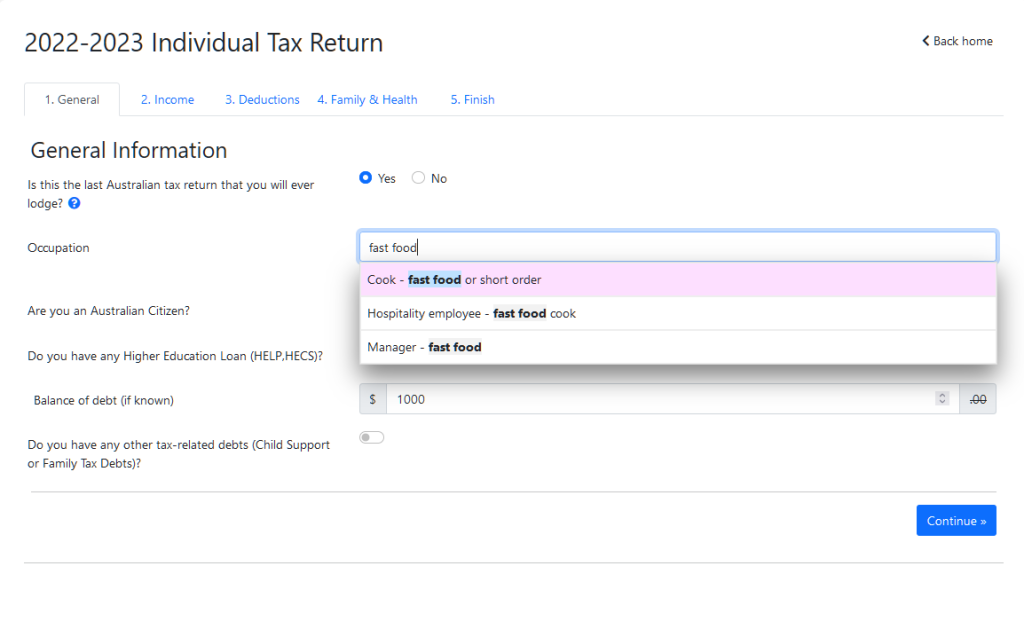

If you are not an Australian citizen you will need to select your visa type.

If you have a HELP or HECS debt, type in the balance of your debt into the field provided. You can check your debt by logging on to MyGov. If you do not know your debt amount, leave the text field blank.

When you have filled in all your general details, click Continue.

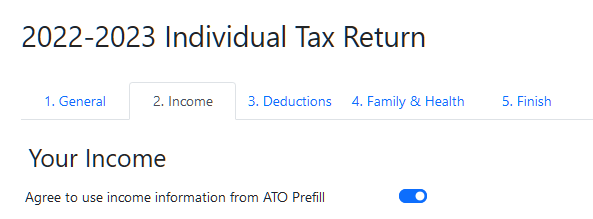

Your Income #

This is where you will provide details on all your sources of income.

If you agree to use ATO prefill data you don’t need to worry about completing most income sections. You should still provide details for other sources of income such as rental properties or sole trader income.

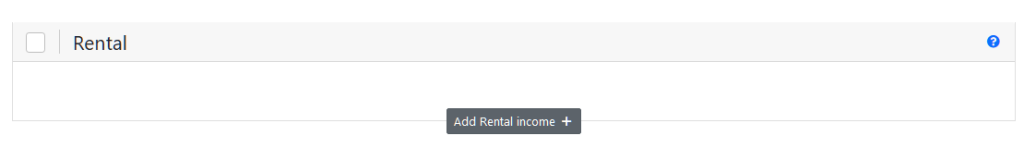

If you have more than one rental property, you will need to click Add Rental Income for each property and add details for each one.

Deductions #

Use the deductions section to claim your work-related expenses. Use the grey Add button below the relevant section to add a new deduction. Supporting documents such as receipts can be included by clicking Browse and uploading the file.

If you have expenses that do not fall under the listed categories, include them under Other. You may be able to claim things such as union fees, overtime meal expenses, professional seminars or conferences, reference books, technical journals, trade magazines, and the work-related portion of tools and equipment.

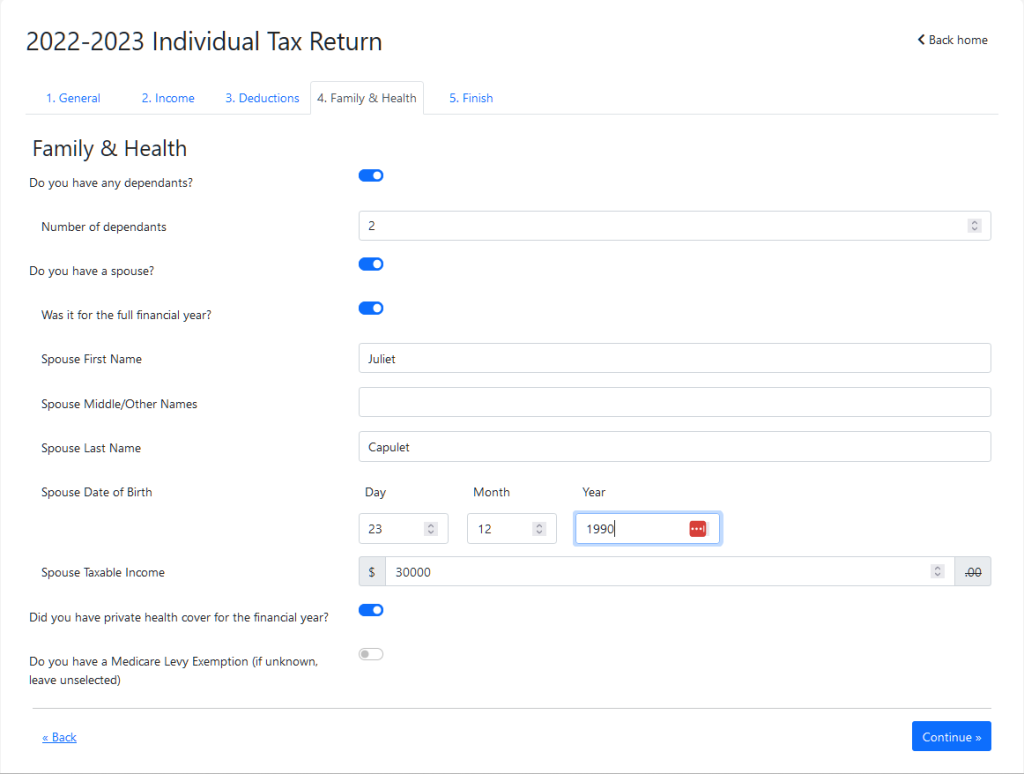

Family & Health #

If you have children or other dependants, or a spouse, you will need to include their details in this section.

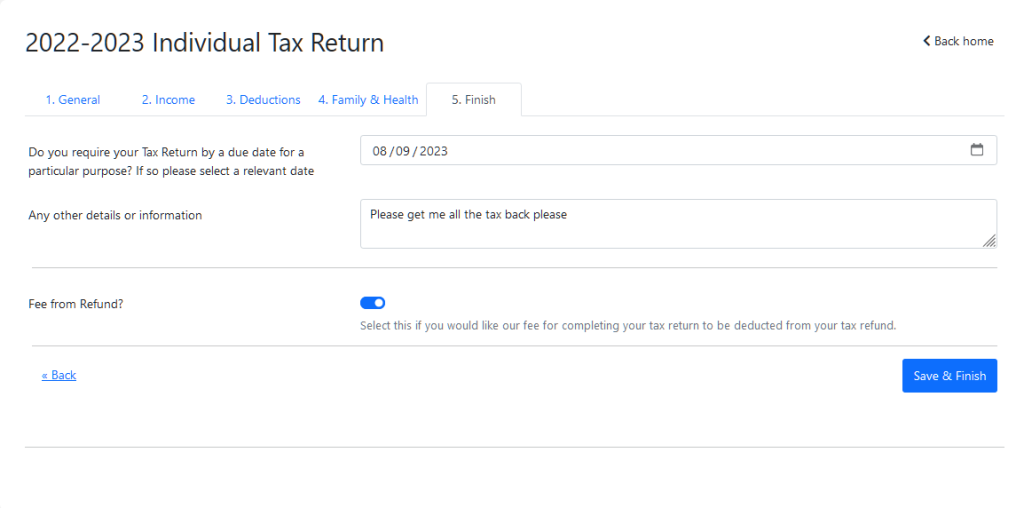

Finish #

Select whether you would like the tax agent’s fee to be deducted from your tax refund and check all information provided is correct. Once you have finished, click Save & Finish.