As of the 13th November 2023, the Australian Taxation Office (ATO) has introduced new requirements for the way entities allow accountants and bookkeepers to act on their behalf.

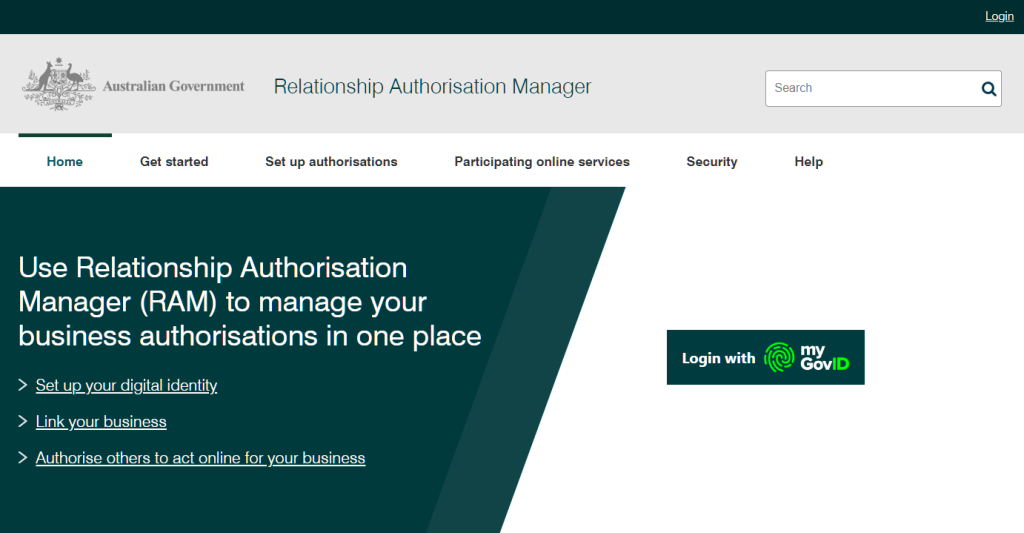

The new Agent-Client Linking rule aims to make the relationship between tax agents and their clients clearer. For business owners and trusts, this means accessing the Relationship Authorisation Manager (RAM) to link your entity to your Tax/Business Activity Statement (BAS) Agent.

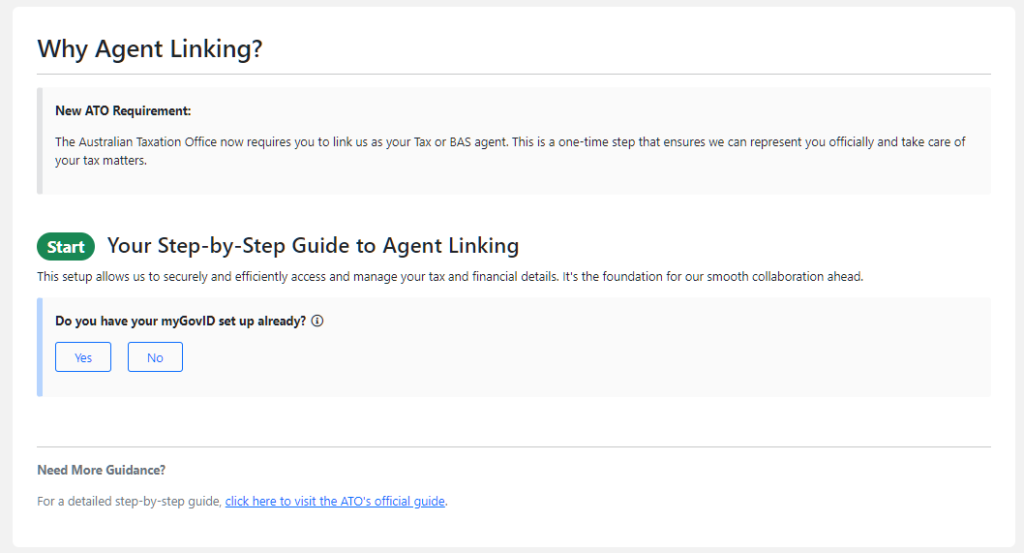

Seamlss has created a step-by-step guide to help you through this process.

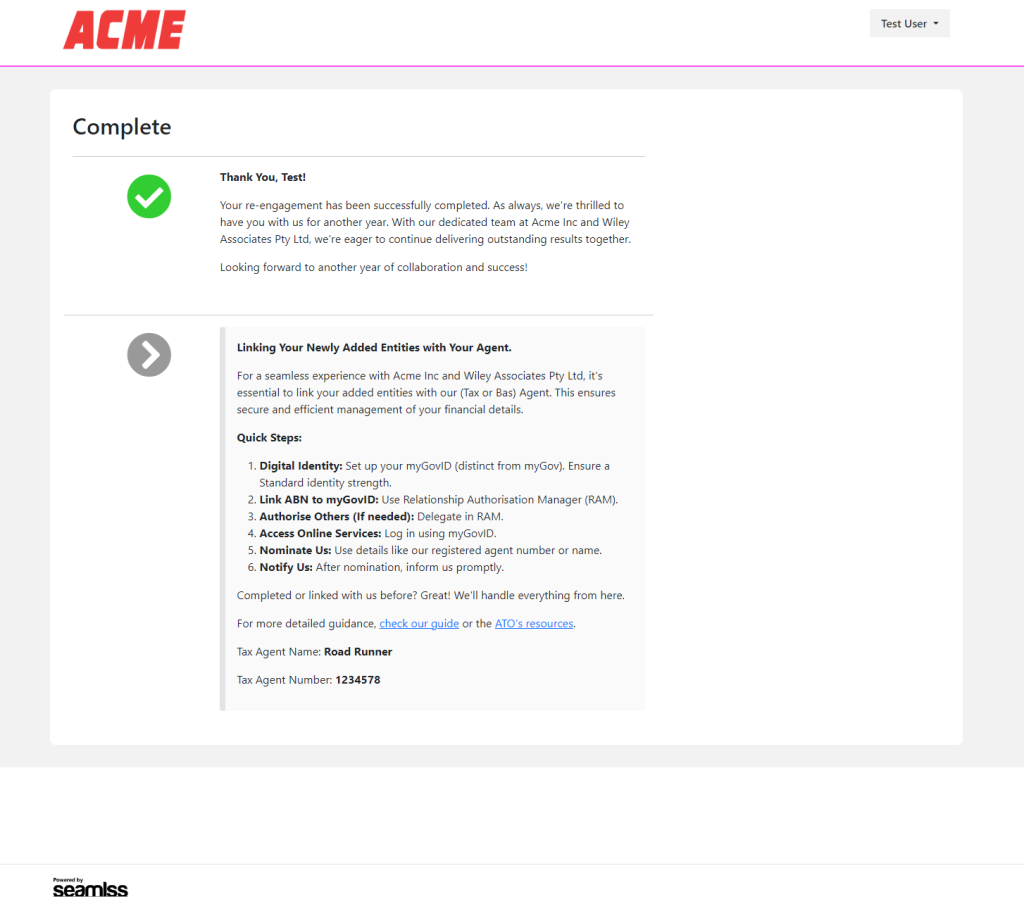

If you added an entity during the onboarding process with your agent, you will be asked to link your enitites to the agent’s firm. Your agent may also send a request for you to complete this process at any other time.

Click on check our guide in the message, or view the guide here. The guide contains clickable options and links to smoothly take you through the process step-by-step.