As tax season hits its peak, efficient data collection becomes crucial for accounting firms. During our recent webinar, we highlighted how Seamlss can transform this often tedious process into a streamlined, seamless experience.

Key Challenges in Traditional ITR Data Collection

- Time-Consuming Processes

Many firms rely on email exchanges for collecting data, leading to a back-and-forth that consumes valuable time. Clients providing hard-copies of their tax return details only adds more data-entry to your workload.

By keeping everything on Seamlss you are saving time by reducing communication lag and time spent on data-entry. - Lack of Standardisation

When data is coming in from multiple sources like email, post, or clients dropping hard-copies into the office, it’s easy for vital information to get missed or forgotten about.

With Seamlss, it’s easy to check what data has been collected because it’s right there on the Client Details page. Following up becomes a breeze with Seamlss Fetch Forms. - Scope Creep

Every accountant has had an experience where a new client has asked for a basic Individual Tax Return, but later on they discover the client has rental properties or capital gains. Not asking the right questions upfront leads to additional, unplanned work, affecting your profitability.

Seamlss reduces scope creep by asking clients the necessary questions during onboarding to fully understand the client’s needs. - Poor Client Experience

It goes without saying that endless emails asking for additional information and creating a back-and-forth that drags out the client’s tax process is going to be frustrating for the client and leave them feeling like they’ve had a bad experience. It’s bad for the client and bad for business.

Seamlss makes tax time quick and painless for accountants and clients alike. Our stackable Fetch Forms create a tailored experience to leave your clients feeling valued and understood so they return to your firm year after year for their tax needs. Happy clients will even refer their family and friends, generating more business for your firm. Win-win!

How Form Stacking Works

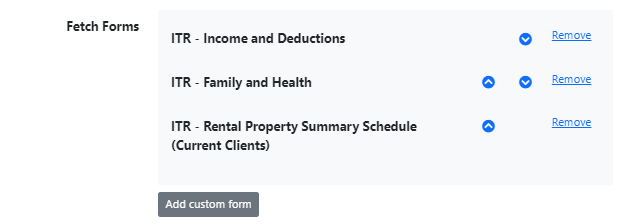

We’ve added bite-size form templates to Seamlss to avoid sending long questionnaires that ask for details the client has already provided. By using these stackable mini-forms, you can easily tailor data collection to each individual client.

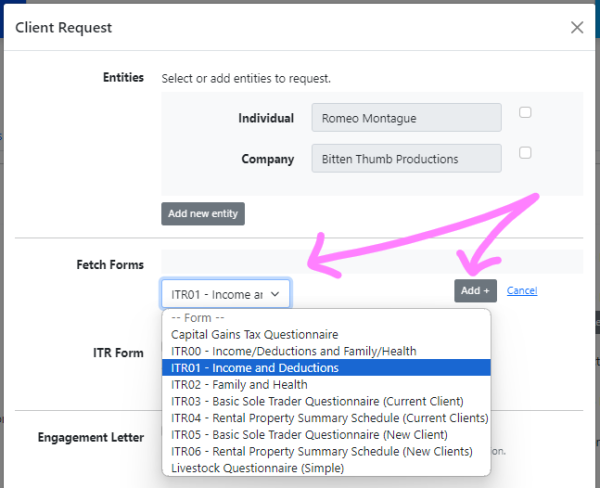

When you re-engage a client, you can stack multiple fetch forms together to create a custom re-engagement request, tailored to your client.

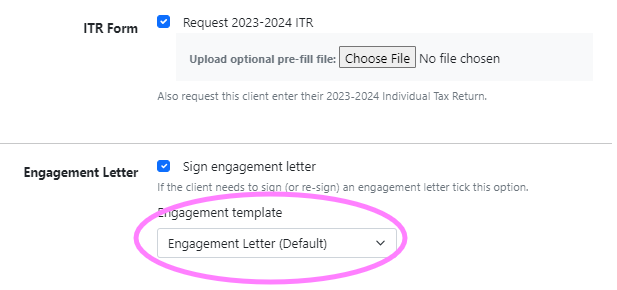

You can then tick whether you want to send the client an engagement letter.

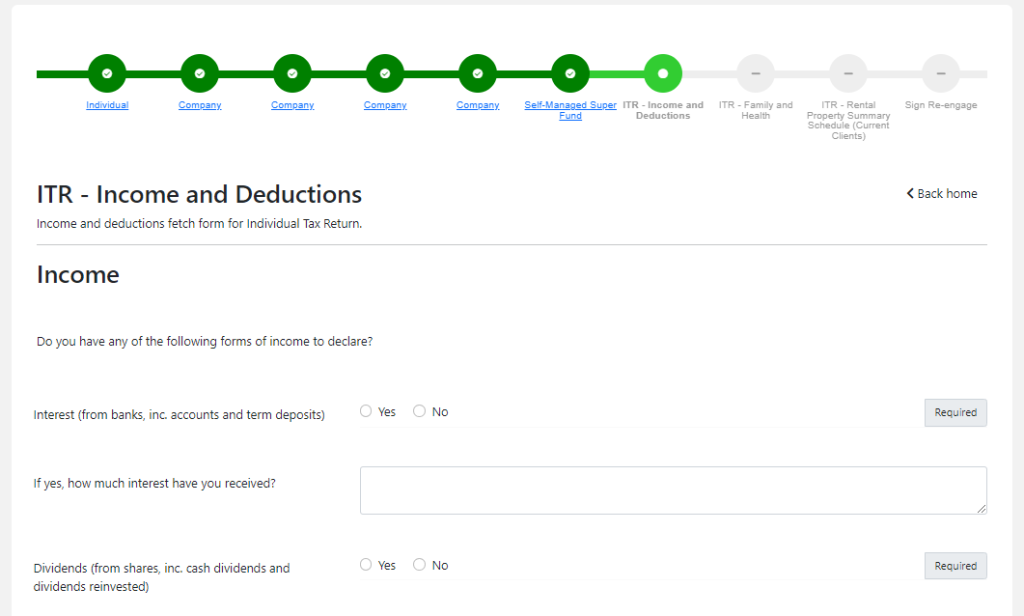

When the client receives the request in their client area, they will be prompted to complete each step in the re-engagement.

By picking and choosing which forms to send to your client, they will feel their time is being valued and their accountant (You!) really understands their needs.

For a full explanation of this process, read our Stacking Fetch Forms help guide.

Why the ITR TaxFlow is a Game Changer for Your Firm

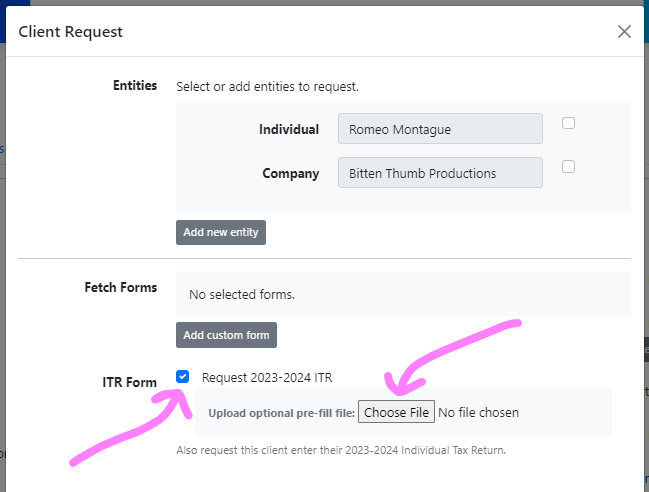

When sending a client request or re-engagement letter, you have the option to Request 20xx-20xx ITR. Instead of breaking the tax return questions down into smaller fetch forms, TaxFlow provides full, detailed data for every section of the ATO Individual Tax Return. Requesting data this was also allows accountants to upload ATO pre-fill data to make the process easier for the client.

What truly sets TaxFlow apart is its adaptability. The tool is designed to evolve based on the client’s input, ensuring a user-centric approach. This dynamic nature eliminates redundancies and ensures that every piece of essential information is captured seamlessly.

By simplifying the process for clients and freeing up resources for firms, it creates more opportunities for meaningful interactions. Firms can use the time saved to offer value-added services, provide personalised tax advice, or even conduct financial health check-ups. These interactions, beyond the transactional nature of tax preparation, can foster trust and loyalty, ensuring long-term client retention.

7 Key reasons to use TaxFlow, the Seamlss ITR Tax Tool

- Streamlined Data Collection

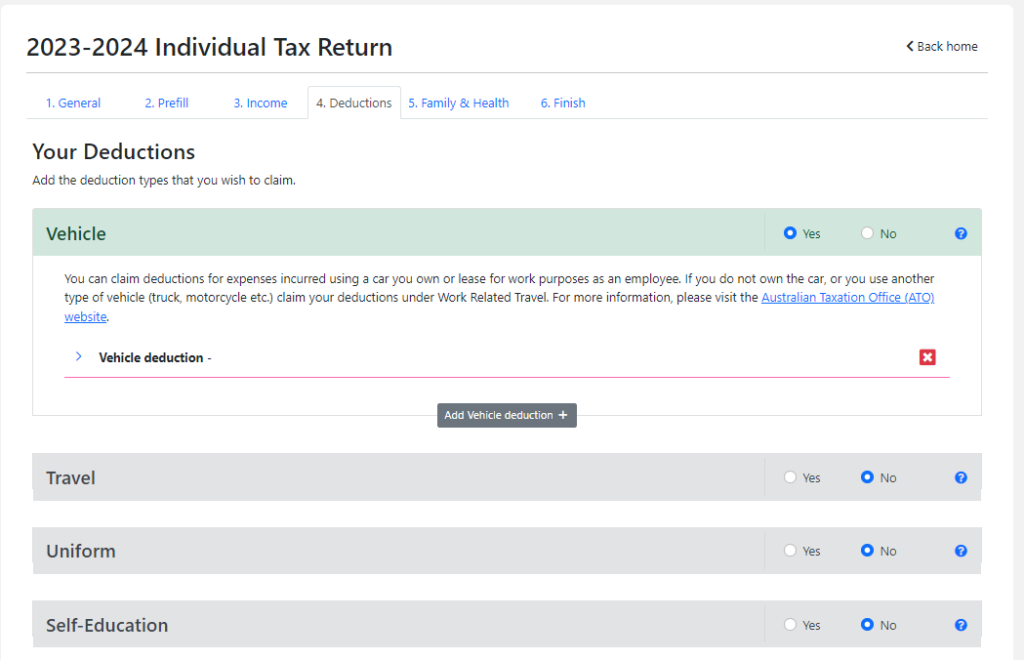

TaxFlow simplifies gathering client data, making the process more efficient and less time-consuming. - User-Friendly Segmentation

The form is divided into bite-sized tabs, each focusing on different aspects like General Information, Prefill, Income, Deductions, Family & Health, and Finish. This structure makes it easy for clients to complete. - Enhanced Data Accuracy

By asking questions in a clear and structured manner, TaxFlow ensures the data provided by clients is accurate and valid, reducing the need for extensive follow-ups. - Pre-Filled Information

TaxFlow integrates ATO pre-fill data, making it quicker for clients to complete and reducing errors. - Gives Accountants a Head-start

When clients complete the form, much of the work for preparing the ITR is already done. This saves accountants significant time and effort. - Repeatable and Consistent

The structured approach ensures a repeatable process that can be easily followed for each client, maintaining consistency in data collection. - Improved Client Experience

Clients find it easier to provide the necessary information, leading to a better overall experience and higher satisfaction.

The ITR TaxFlow Tool revolutionises the way accounting firms collect data from clients. Its intuitive design, segmented structure, and focus on accuracy and efficiency make it an invaluable asset for streamlining the tax preparation process.

Webinar Highlights

- Using Fetch Forms

Fetch forms in Seamlss allow you to collect specific pieces of information from clients. This can include income details, deductions, capital gains, rental property information, etc. By breaking down data collection into smaller forms, clients find it less overwhelming and more manageable. - Customizing Forms

The webinar demonstrates how easy it is to edit and customize forms in the forms section of the Seamlss app. You can add descriptions, change response types, and mark certain fields as required to suit the needs of your firm. - Client View and Interaction

The webinar provides a useful view of how clients interact with the forms. Clients receive an email with a link to their personalized forms. They can fill out details, upload supporting documents, and submit their responses securely. You can also send an SMS reminder to clients to go online and complete their forms. - ITR TaxFlow

Using the Seamlss ITR TaxFlow tool allows you to integrate ATO pre-fill data, making it easier for clients to confirm and update their information.

Watch the Webinar

✅ How to leverage Seamlss for simplifying ITR preparation

✅ Best practices for collecting and verifying client data efficiently

✅ Practical tips for using Seamlss fetch forms to gather necessary documents

✅ How to automate data collection and minimize errors

✅ Strategies to improve client engagement and satisfaction

Key Highlights:

0:00 – Introduction to Seamlss and its benefits for accountants

2:00 – Demonstration of Seamlss forms and templates

5:30 – Adding and customizing fetch forms for ITR data collection

10:00 – Client view and data submission process

13:00 – Using the ITR tool for detailed and dynamic data collection

Ready to streamline your ITR data collection process? Explore Seamlss today and see how it can transform your firm’s efficiency. For more information visit Seamlss to get started.