Join our exclusive session and discover how Seamlss transforms client onboarding and data collection

Streamline Your Tax Returns with Seamlss TaxFlow!

Revolutionise your ITR collection process for the 2023 tax season.

No credit card required.

Why Choose Seamlss TaxFlow?

- End tedious data collection.

- Enhance client meetings with prepared data.

- Reduce the need for face-to-face appointments.

- documents are securely collected and accessible.

- Use TaxFlow with your current systems

Tired of endless emails phone calls meetings back-and-forth?

Seamlss TaxFlow’s dynamic ITR collection streamlines communication, ensuring all details are captured efficiently.

Dive into Seamlss TaxFlow's Innovative Features

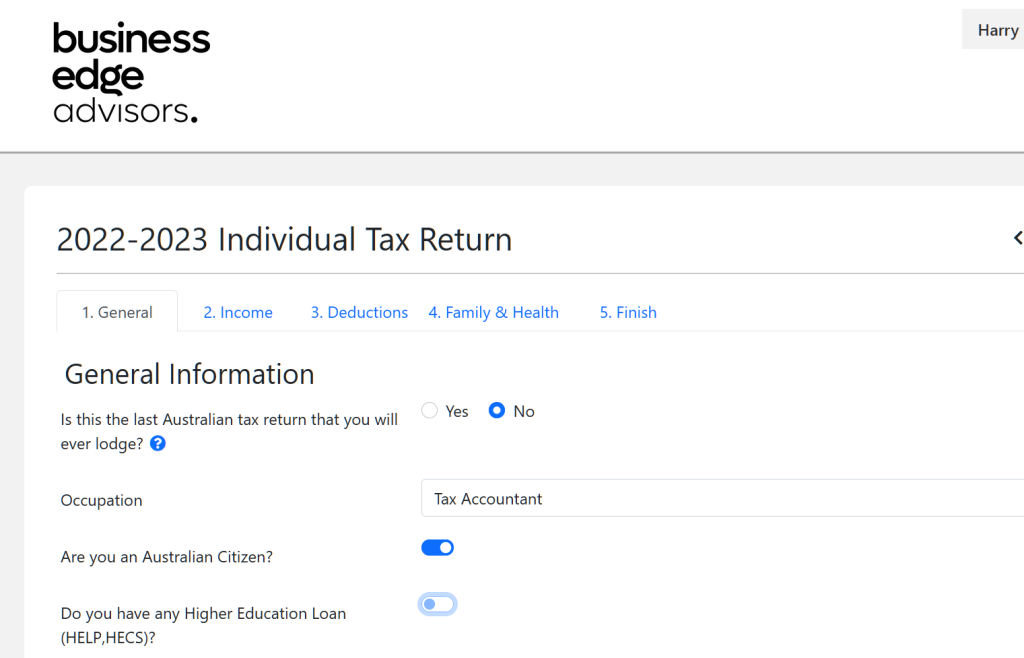

Dynamic ITR Collection

Go beyond traditional methods. With TaxFlow, capture every detail, from dividends to rental properties, in a streamlined manner.

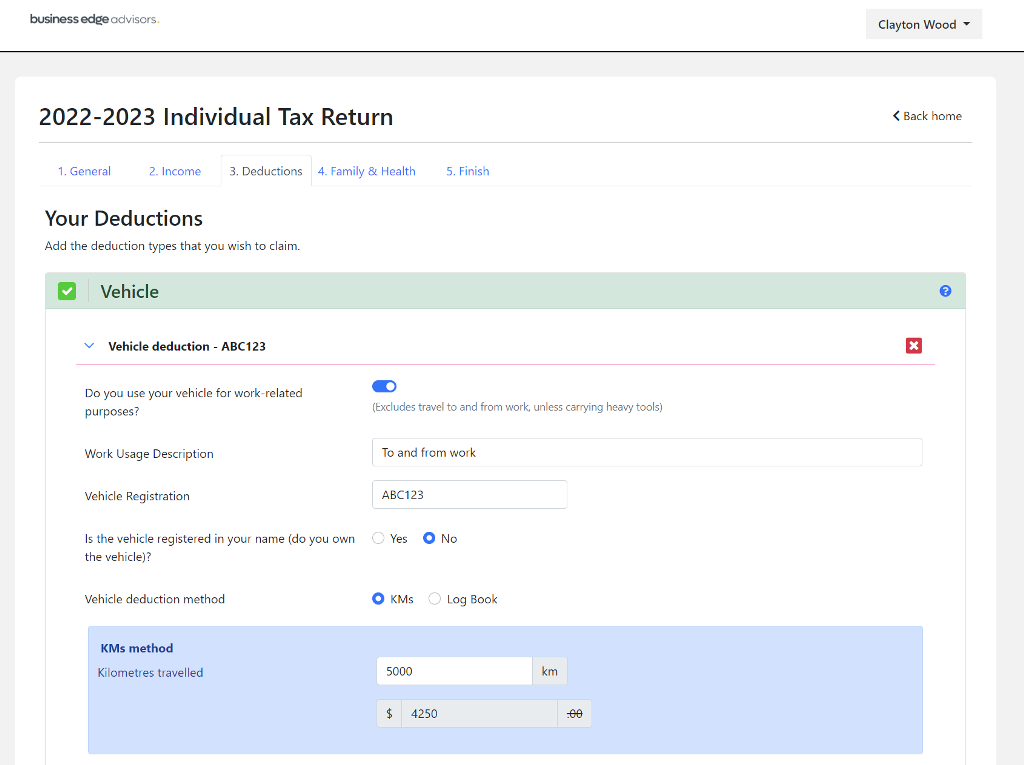

Adaptive Forms and Questions

Our forms evolve based on client input, ensuring a tailored experience. Say goodbye to redundant questions and hello to efficiency.

Effortless Document Handling

Collect and manage all necessary documents within TaxFlow, eliminating the clutter and chaos of traditional methods.

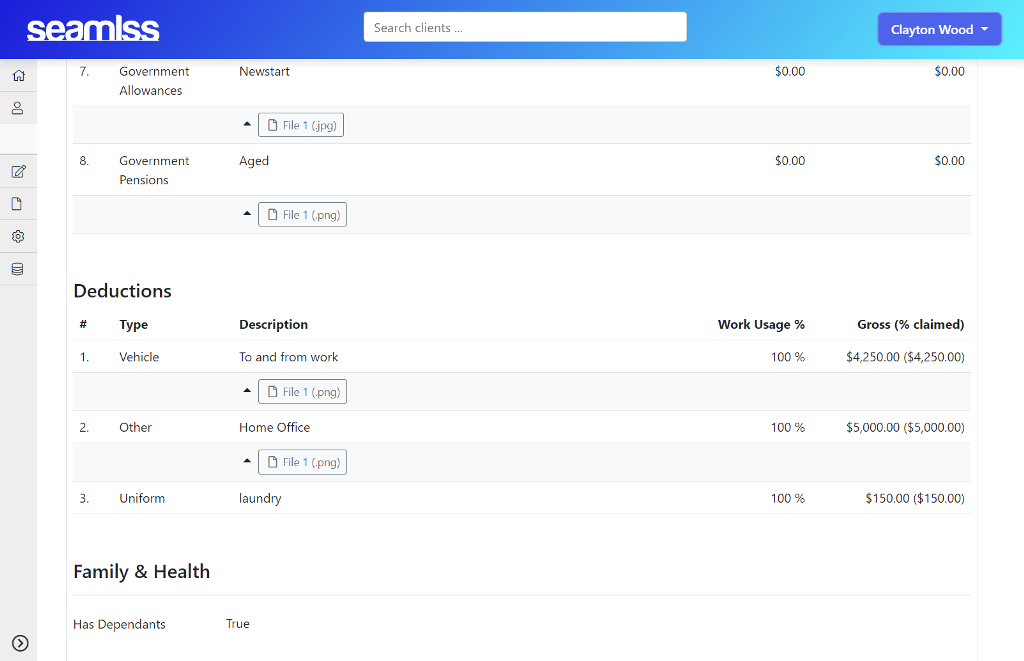

Use it as a Workpaper

Download client tax return summary in PDF format with a single click. Easy to review, share, or print with your team.

Accurate Data Retrieval

Use Fetch Forms to gather additional or missing information from clients, ensuring comprehensive and precise data collection.

All-in-One Onboarding and Verification

Onboard clients, complete their ITR, engage, and verify all in one smooth process, enhancing efficiency.

Overwhelmed by stacks of endless peices of paper? never ending questions? growing task lists? looking for documents?

With Seamlss TaxFlow, all client documents are neatly organised and easily accessible at your fingertips.

Ready to Transform Your Tax Season?

Join the Seamlss TaxFlow revolution today and experience seamless efficiency.

No credit card required.

Frustrated by last-minute appointments... rushed preperations.... unprepared clients...

Seamlss TaxFlow’s proactive approach lets you prepare in advance, turning client meetings into value-driven discussions.

Accountants that trust us:

Owner Director Read More

Simple, time-saver for onboarding clients

I was so happy I found Seamlss - not only is it seamless for clients, but implementing it into our onboarding process was quick and easy.

I had been looking for something that integrated with Xero Practice Manager for ages and made collecting client details easy. The mobile phone authorisation code means that clients don't have to set up another login to access the forms and the process is quick and easy for them.

From a practice viewpoint it's also great that you can link other software using zapier that speeds up the onboarding process even more.

Owner Director Read More

Genuine time-saver!

Seamlss saves so much time in the Client Onboarding process, all you need to provide is an email address and mobile phone number, Seamlss does the rest. Syncing directly to Xero reduces data entry time and the possibility of keying errors. This software is invaluable to my Practice.

Principal Read More

I have been waiting for this program!

Seamlss is the program I have been looking for since starting with Xero Practice Manager. It automates the onboarding process in a very simple way that is secure, professional and fast.

Owner Director Read More

On boarding new clients was a major pain point for my business. There wasn’t anything on the market that could help and most online form apps just weren’t secure enough for my liking.

Most of my other software packages didn’t offer what I needed, and I had a massive black hole in my automation strategy.

My admin now sets up all my new clients prior to their appointment so I am ready to go once they arrive.

It has reduced my stress levels for the new client appointments. And I love that I can see a bit about them prior to the appointment via their ATO report.

Having new clients sign an engagement form with my custom terms built in has been great and it has saved so much time with double handling.

Previous

Next

Onboard into Xero Practice Manager