In the dynamic world of accounting, the annual task of collecting Individual Tax Return (ITR) data has often been a bottleneck for many firms. This process, while essential, can be fraught with inefficiencies. Enter Seamlss, a beacon of innovation designed to transform this experience, particularly as we gear up for the 2023 tax season in Australia.

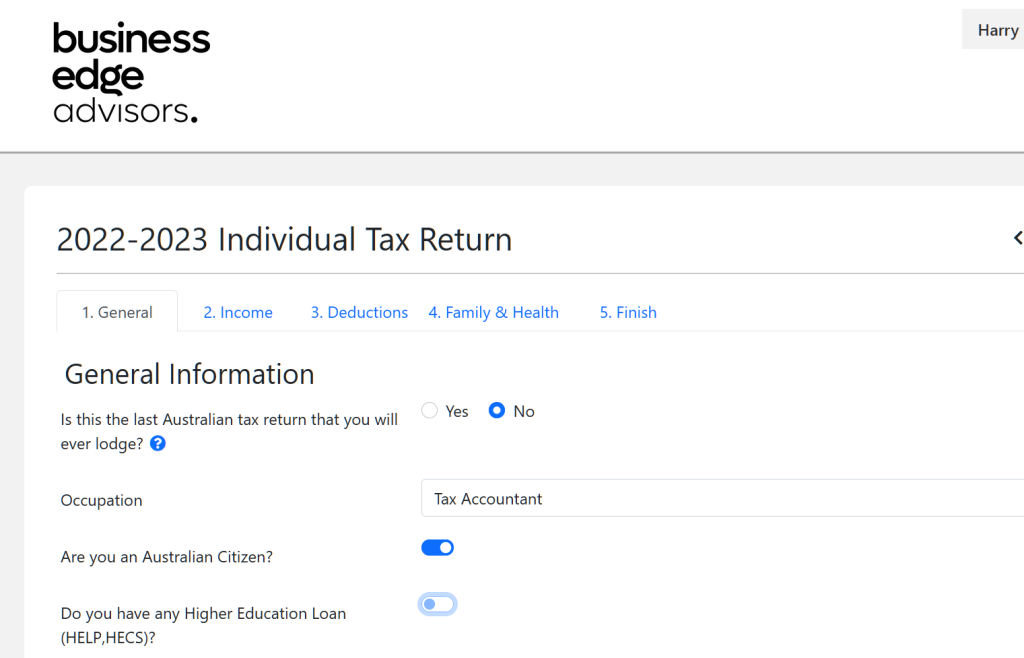

Introducing TaxFlow, our new ITR collection tool, with a client view of the starting screen. Seamlss: Your Comprehensive ITR Solution with TaxFlow at its core, Seamlss is more than just a tool; it’s a comprehensive solution tailored for the modern accounting firm. Let’s break it down below.

Seamlss: A Comprehensive ITR Solution

At its core, Seamlss is more than just a tool; it’s a holistic solution tailored for the modern accounting firm. Let’s break down its multifaceted approach:

Dynamic ITR Collection with TaxFlow

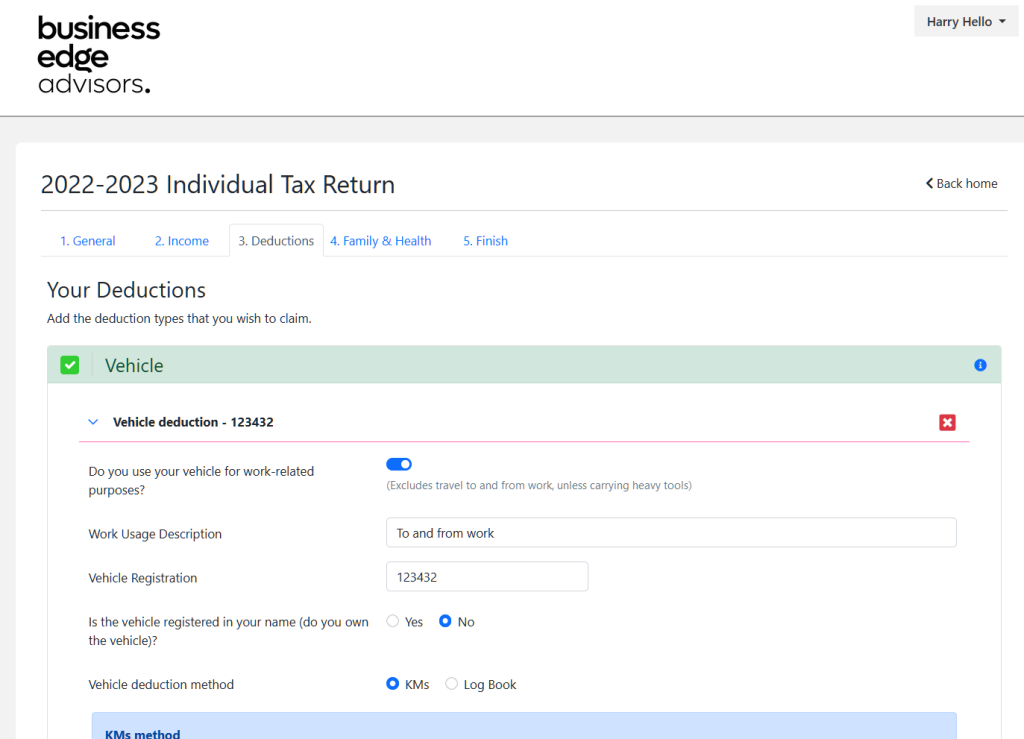

Unlike traditional methods that often involve tedious back-and-forths, Seamlss offers TaxFlow, a dynamic ITR collection tool. This isn’t about just skimming the surface; it’s about diving deep. From capturing intricate income details, spanning from dividends to managed funds and rental properties, to collecting exhaustive data on expenses, TaxFlow ensures a thorough data collection process.

Adaptive Forms and Questions

What truly sets TaxFlow apart is its adaptability. The tool is designed to evolve based on the client’s input, ensuring a user-centric approach. This dynamic nature eliminates redundancies and ensures that every piece of essential information is captured seamlessly.

Digital Engagement Letters for Existing Clients

In addition to simplifying the ITR collection process, Seamlss also facilitates the easy signing of digital engagement letters within the app. This feature ensures that all necessary documents are securely collected and accessible. It provides an added layer of convenience for your clients and efficiency for your firm, as it eliminates the need for physical paperwork and streamlines the document signing process.

Streamlining ITR queries process with Seamlss’s Fetch Forms

Gathering additional information from clients to assist in ITR completion often involves inefficient and error-prone communication methods. Seamlss’s Fetch Forms revolutionise this process, offering a streamlined way to ask further questions or request additional data from clients. Fetch Forms are dynamic and customisable, eliminating the need for back-and-forth emails or phone calls, saving time for both parties.

Moreover, Fetch Forms allow secure collection of important documents, such as deduction receipts, directly from clients. This ensures all data is securely collect and accessible for the accounting firm, simplifying the process for the client and enhancing the overall client experience. Seamlss’s Fetch Forms are a powerful tool for accounting firms during the ITR process.

Re-Engage & Prepare for 2023 with TaxFlow: A Win-Win for Firms and Clients

As the 2023 tax season looms, proactive engagement becomes the linchpin for accounting firms. It’s not just about ticking boxes; it’s about fostering trust, ensuring accuracy, and delivering unparalleled service. Seamlss, with its innovative approach, is poised to redefine this engagement, creating a symbiotic relationship between firms and their clients.

For firms, the traditional ITR collection process can often feel like navigating a maze. TaxFlow transforms this maze into a straight path. By automating and streamlining data collection, firms can allocate their resources more effectively. Instead of getting bogged down with manual data entry or chasing clients for information, professionals can focus on analysis, advisory roles, and strategic planning. This not only enhances the firm’s productivity but also positions it as a forward-thinking entity in the eyes of its clients.

Efficiency and Precision for Firms

Moreover, with TaxFlow’s dynamic tools, firms can ensure that the data collected is comprehensive and accurate. This minimises the risk of errors, saving time in revisions and ensuring that the ITRs prepared are compliant with the latest regulations.

Simplicity and Empowerment for Clients

For clients, the tax season can often be daunting. The apprehension of missing out on crucial information, the tediousness of paperwork, and the time commitment can be overwhelming. TaxFlow addresses these pain points head-on. Its intuitive interface guides clients through the process, ensuring they provide all necessary information without feeling overwhelmed.

The platform’s dynamic nature means that clients are only prompted for relevant information, eliminating unnecessary steps and making the process more efficient. This can often negate the need for prolonged appointments, as clients can provide all the required data at their convenience.

Furthermore, the digital engagement letters and the fetch request system empower clients, giving them clarity and control. They can initiate processes, seek clarifications, and provide additional data without the traditional barriers of scheduling and waiting.

Building Stronger Relationships

At its core, TaxFlow is not just a tool; it’s a relationship builder. By simplifying the process for clients and freeing up resources for firms, it creates more opportunities for meaningful interactions. Firms can use the time saved to offer value-added services, provide personalised tax advice, or even conduct financial health check-ups. These interactions, beyond the transactional nature of tax preparation, can foster trust and loyalty, ensuring long-term client retention.

In essence, as we approach the 2023 tax season, TaxFlow emerges as more than just a platform; it’s a catalyst for change, driving efficiency, enhancing client experiences, and fostering deeper relationships.

Optimising Client Meetings and Reducing Appointment Needs with TaxFlow

One of the standout benefits of TaxFlow is its potential to revolutionise client meetings. In traditional scenarios, a significant portion of client appointments is spent gathering data, clarifying ambiguities, and ensuring all necessary documentation is in place. This often results in prolonged meetings, where the actual discussion around tax strategies, financial planning, or advisory takes a backseat.

With TaxFlow, firms can flip this script. Since clients provide all the required data in advance, professionals can prepare the tax return and collate all necessary information before the client even walks through the door. This proactive approach ensures that meetings are more focused and productive. Instead of data collection, the emphasis shifts to value-driven discussions, where clients can gain insights, ask questions, and receive tailored advice.

Moreover, in many cases, the comprehensive and intuitive nature of TaxFlow might eliminate the need for an appointment altogether. Clients who are familiar with their financial situations and have no significant changes from the previous year can seamlessly provide their data through the platform. The firm can then prepare the ITR and send it to the client for review and approval, all without a face-to-face meeting. This not only saves time for both parties but also caters to the evolving preferences of a digital-first clientele.

Incorporating TaxFlow doesn’t just mean streamlining processes; it means reimagining the client-firm interaction paradigm. By focusing on preparation and value delivery, firms can ensure that every client interaction is meaningful, efficient, and geared towards building lasting relationships.

The TaxFlow Advantage

By integrating these features into one seamless process, TaxFlow makes it easy for accounting firms to streamline ITR collection for current clients and prepare for the 2023 tax season. The ease and efficiency of the process can significantly enhance a client’s experience, making them more likely to continue using your services. With TaxFlow, the upcoming tax season can be less of a hassle and more of an opportunity for growth and client satisfaction.