Client Verification Made Easy

How Firms Digitally Onboard & Verify

Collect Client ID's

Using Seamlss means you're collecting the documents securely, easily and quickly.

Easy for Firms & Easy for Clients

Simple and Easy interface

We made it simple for clients to use their phones to take a photo or upload via their computer. We know some systems require a cumbersome process to get clients to do anything, so we made it secure and easy.

Secure

No client data over email and everything is at your finger tips. All data is located in Australia managed to a GDPR standard, and transactions are handled via banks-grade SSL security.

Process

Use Seamlss to collect client ID's and data when onboarding. It's time to get off email and paper. Have clients in the ATO portal and loaded into Practice Management software before they arrive.

VERIFY FAQ

It's time to make Client Verification a process

How does it work?

When onboarding clients the Seamlss onboarding form will also ask for verification documents for you to use to verify their identity against the ATO’s process.

ATO Verification Options

We’re following the processes outlined by the ATO’s best practice. The system is self-service, but this also ensures the price is kept low by using a clients ID and/or an ATO source document for the team to check. See the ATO for more here.

Verification Method

You must verify two separate proof of identity documents using one, or a combination of the methods outlined by the TPB & ATO.

The exception is when a primary photographic proof of identity document can be verified (such as a drivers licence), when you are interacting with the client in person or by video. This can be awkward for some team members. Seamlss avoids awkward requests and makes it a part of your onboarding process.

Security Matters

We have implemented secure connections and links to allow data to flow from clients to you securely. No documents or data is sent over email and the data is held in Australia on local cloud servers. Only your designated users can access the data collected.

Why do firms need this?

Starting with strong client verification helps to protect the tax system, the firm and your clients. Using Seamlss allows you to leverage technology and remote work practices while reducing the risks presented by this. Why create a new process or system, just use Seamlss to quickly onboard clients and verify them all at the same time.

DVS (Document Verification Service)

While we don’t offer this service yet, we’re also not charging per verification check using Seamlss. The verification method used in Seamlss is built into the product to make it quick and easy for firms that don’t require to pay for a DVS check. There is no requirement for you to use a DVS service by the ATO or TPB, just use Seamlss to verify clients as a part of your onboarding process.

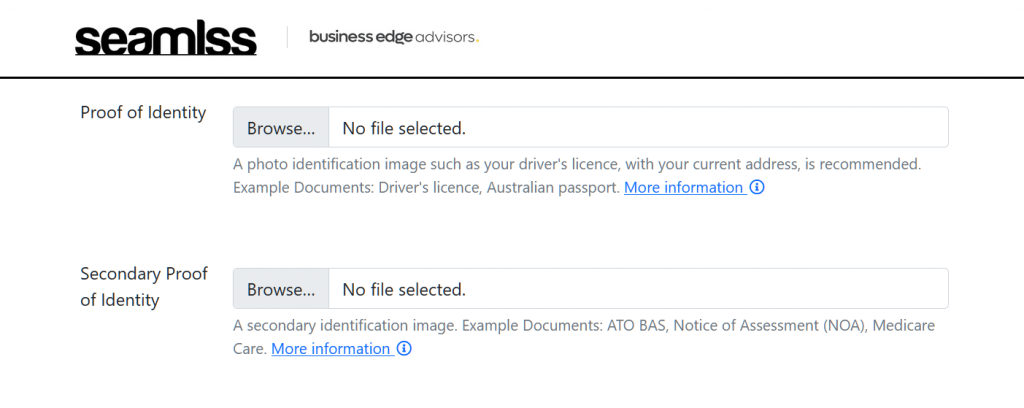

Built into our Client Onboarding Form

Clients will verify along their onboarding journey and simply clicking on the More information link shows what type of documents they can upload.

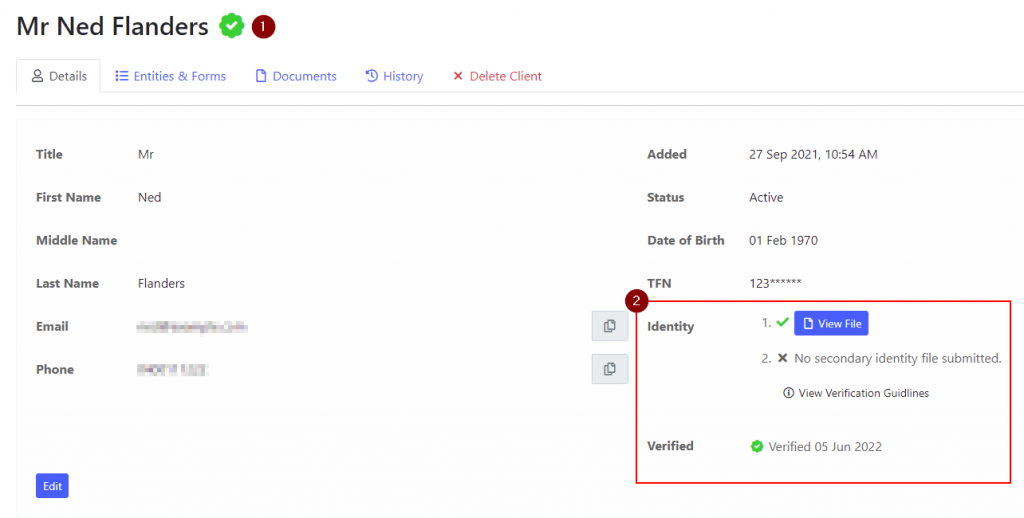

Client Dashboard

The client’s dashboard allows users to view files for verification. Once verified, clients are displayed with a big, green tick. The client dashboard also shows the date verified and any changes are logged.