ATO Identity Verification Required: What You Need to Know

Why does the ATO require identity verification?

The ATO requires identity verification to ensure that the person accessing tax information or services is who they claim to be. This helps to prevent identity theft and fraud, which can have serious consequences for both individuals and the government. By verifying your identity, the ATO can also ensure that your personal information is kept secure and confidential.

Tax Practitioners are on the frontline of dealing with Australians’ tax needs and are required to verify clients’ identities to ensure the tax system’s integrity. Unfortunately, some tax practitioners have been victims of identity fraud, which has resulted in the potential compromise of sensitive taxpayer information and the theft of clients’ money. This has significant ramifications for clients, the tax system, and the Australian economy.

Seamlss is the easy way to onboard your clients, verify them, and keep them compliant. Onboarding takes minutes, verification takes seconds, and compliance takes care of itself. Let us help do the background checks, document review, and compliance work so you can focus on your clients. We’re the easiest way to onboard, verify, and stay compliant with your requirements.

These guidelines are part of the TPB and ATO’s transition towards mandating minimum standards of client verification. These guidelines should be read as minimum requirements, if you’re unsure you need to go beyond these requirements by taking reasonable care to verify.

Your Current Clients at Risk?

Firms do not need to go back and verify their entire client base. But they should be on alert for suspicious behaviour. Especially when a client is dismissive of the client verification process, does not want to complete it, or provides documents that appear to be fake or otherwise unusual.

This behaviour indicates heightened risk, particularly in situations such as:

- requests for bank account changes

- requests to amend tax returns or statements (particularly to increase refunds)

- requests to lodge returns or statements with significant or unusual refunds

- rollover requests to release or rollover super

- requests for information off ATO systems including pre-fill information

- request for personal information that would ordinarily be known to individuals or entities

- where a person is acting on behalf of another person or multiple persons.

While many firms remain vigilant, criminals are becoming more sophisticated and will use everything from fake documents, to use for phishing and social engineering to try and gain access to clients’ accounts or refunds.

Verification methods

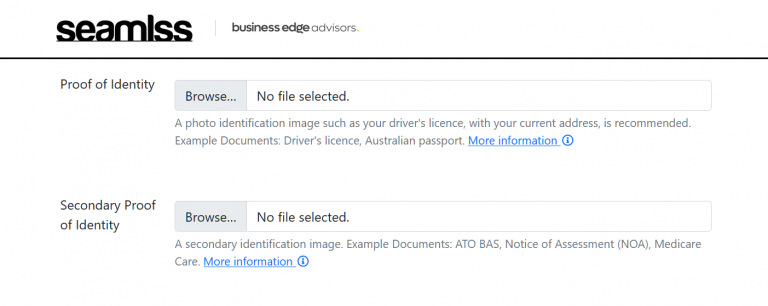

Visual (inc with Seamlss)

You can visually check a client’s identification documents in person or by video conference. While for most clients, a visual check of a driver’s licence will be all that is needed, this can be awkward and confronting for some team members or make the client embarrassed.

ATO Source Documents (inc with Seamlss)

You can request a client to show ATO source documents provided by the client against data on ATO systems. This is great for either in-person or video conferencing interactions, remote interactions, and digital interactions through software like Seamlss.

DVS Provider (paid solution)

You can pay to use a DVS provider to compare a client’s details on government-issued identity documents against details held by a DVS provider. This method usually costs per request made for every client. This method is suitable for in-person (including video) and remote interactions. Can be used to prove the identity of an individual representative of your client. This method is not yet offered by Seamlss as the process is baked into the process of onboarding with Seamlss as is at no extra cost.

Combinations of options to verify using Seamlss

Source + Source documents

After collecting the client’s details via Seamlss, you can use two separate proof of identity documents using the “Visual + Visual” method. Verify at minimum 2 visual identity documents (original non-photographic identification document or secondary identification document)

The recommended method – Visual ATO Source Document

When onboarding clients receive a client’s Visual ID + Source ATO. Visual (original non-photographic identification document or secondary identification document) and Verify at minimum 2 pieces of information verified using Source ATO like address and date of birth.

What does this look like for the team?

Sight your client’s identity documents online with Seamlss like their primary photographic ID provided, and ensure the photo matches the person. Confirm visually the details on the documents match those given by your clients such as name, gender, address, and DOB.

Or use ATO source documents to verify, at minimum, 2 further pieces of information against ATO systems. You can only use the following information:

- bank account details

- details from an ATO-generated notice or lodged return that you can confirm on ATO systems:

- notice of assessment sequence number or reference number

- activity statement document identification number

- correspondence reference number

In order to check the data from the client against the ATO you will need to obtain written or electronic authorisation from the client to act on their behalf. Link them to the client record using their TFN and DOB, or ABN and name, for example, engagement letters signed via Seamlss.

Example: visual verification

Jane books into Tony’s tax practice to lodge her tax return. Tony sends a Seamlss onboarding request to collect Jane’s details securely before she arrives. Jane fills in her details and add’s her Drivers license. Tony visually verifies Jane’s identity by sighting her driver’s licence and confirms the photo, name, and DOB matches that of Jane to add her to the ATO portal and practice tools.

Tony uses his practice management software to record the date, time, and identity document sighted. Tony does not retain, nor is he required to keep, a copy of Jane’s driver’s licence.

Example: source ATO method

Tina seeks the services of Sam, a BAS agent, to help manage the books for her gardening business that she operates as a sole trader. Sam sends an onboarding request to Tina. Once filled in Sam has a signed letter of engagement for providing Tina with permission to initiate a client/agent relationship through ATO systems and provides her ABN and DOB.

Once linked, Tina shows Sam evidence of her bank account details and recent activity statement document identification number, which Sam is able to sight and verify against ATO systems.

Satisfied that client verification has been completed, Sam agrees to take Tina on as a client and records the completion of client verification, including date, time, and the documents that were sighted to confirm their identity of the practice management tool.