The new Agent-Client Linking process introduced by the Australian Taxation Office (ATO) is a notable shift for accounting and bookkeeping firms across Australia. This process aims to streamline how tax practitioners and their clients interact, but it brings its own set of challenges. A key concern is the accidental disconnection of a Business Activity Statement (BAS) agent, requiring a re-authorization that could be time-consuming, especially if discovered late.

Being well-prepared for this change is crucial for firms. It involves understanding the new system, informing clients, and adjusting operations accordingly. Seamlss has updated its platform to help navigate this transition. Now, it provides a step-by-step guide during client onboarding and a Fetch Form explaining the Agent-Client Linking process post-onboarding.

Agent-Client Linking process maybe a challenge, preparation steps for a smooth transition, and how firms are adapting to this new regulatory landscape.

Understanding Agent-Client Linking:

The Agent-Client Linking process is designed to formalise the relationship between tax agents and their clients, ensuring accurate representation. While it’s a step towards better transparency and streamlined operations, it demands both the firms and clients to be well-versed with the new system. This includes understanding the correct way to link agents to clients to prevent any inadvertent disconnections or unauthorized changes. A well-executed linking process not only complies with the ATO’s regulations but also paves the way for a smoother interaction between firms and clients, reducing the room for errors and misunderstandings.

Preparing for the Transition:

Transitioning to the new Agent-Client Linking process is an involved process that requires careful preparation. Here are steps firms can take, and how Seamlss can facilitate a smoother transition:

- Educate:

- Conduct training sessions to educate your team on the new linking process, utilising Seamlss’s resources for better understanding.

- Stay updated on any new guidelines or updates from the ATO regarding Agent-Client Linking, and use Seamlss’s platform to keep your team and clients informed.

- Update Operational Procedures:

- Modify existing operational procedures to align with the new linking process, leveraging Seamlss to streamline process to automate many of these modifications.

- Ensure your systems are compatible with the ATO’s updated online linking system, with Seamlss serving as a reliable tool for managing client onboarding and engagements.

- Client Communication:

- Inform clients about the new Agent-Client Linking process well in advance, utilising Seamlss’s Fetch Forms to send to send out informative emails and confirmation.

- Explain the importance of the new process in person, by video or email and how Seamlss can help simplify the transition for them and your team.

- Create Informative Resources:

- Develop easy-to-understand guides or FAQs for clients with the help of Seamlss’s resource library.

- Share these resources via email, your website, or during in-person meetings.

- Test the Process:

- Conduct internal tests to ensure your firm is ready for the transition, using Seamlss to identify and address any potential issues and ensure its a smooth easy process for clients.

- Address any issues that arise during testing to prevent future complications.

- Seek Feedback:

- Seek feedback from clients to understand their concerns or questions, using Seamlss to collect and manage this feedback efficiently.

- Offer additional support or clarification as needed.

- Provide a Smooth Onboarding Experience:

- Leverage Seamlss’s step-by-step guide during the client onboarding process to educate clients about Agent-Client Linking.

- Leverage Seamlss when onboarding to assist with data collection, identity verification and signing of engagement letters.

- Maintain Open Communication:

- Keep the lines of communication open for any queries or assistance clients might need, with Seamlss facilitating seamless communication between your firm and clients.

- Update clients on any new developments or changes in the process through Seamlss’s communication features when clients are onboarding.

By incorporating Seamlss in the transition strategy, firms can not only ensure a smooth hand over with the new Agent-Client Linking process but also enhance their operational efficiency and client communication, making the transition smoother and well-organised.

How Seamlss Aligns with the New Changes:

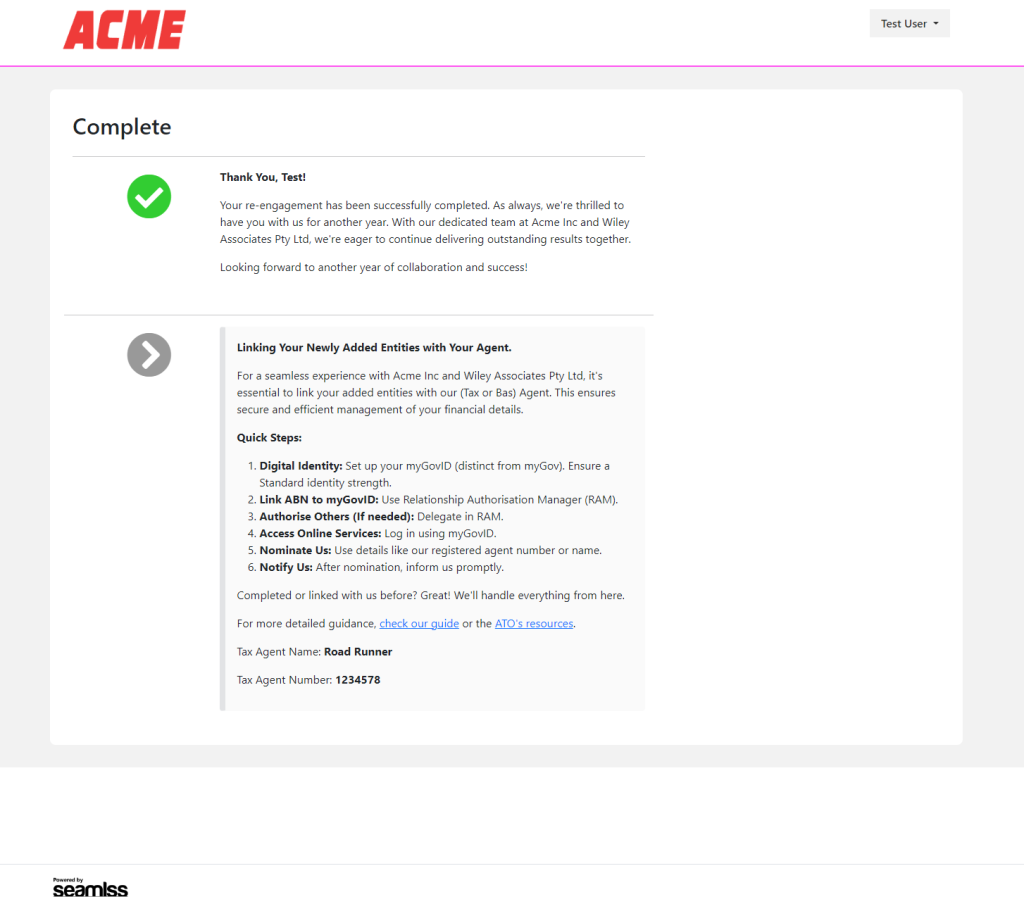

In response to the ATO’s Agent-Client Linking initiative, Seamlss has fine-tuned its platform to be in sync with these new regulations. Central to this is the additional guidance provided to both firms and clients, making the transition less complex and more structured. Seamlss not only aids in the smooth onboarding of clients but also serves as a conduit for clear communication regarding the new linking process for clients.

Step-by-Step Guide using Seamlss:

Client Onboarding:

- As a firm initiates the onboarding process on Seamlss, a step-by-step guide is displayed, explaining the Agent-Client Linking process.

- The guide is easy to follow, ensuring that both the firm and the client understand the new linking protocols.

- This area is also editable to allow firms to use their own tone and links when explaining it to clients.

Utilising Seamlss’s guidance feature during onboarding and sending a Fetch Form post-onboarding, firms can ensure that the transition to the new Agent-Client Linking process is well-communicated and understood by all parties involved. This methodical approach minimises confusion and equips firms and clients with the knowledge needed to navigate this new regulatory landscape effectively.

Additional Resources:

Navigating the new Agent-Client Linking process can be intricate, but various resources can provide clarity and guidance. Below are some valuable resources for further reading and understanding:

- ATO Guide on Client-Agent Linking:

- The Australian Taxation Office (ATO) provides a detailed guide on the steps involved in Client-Agent Linking. It’s a reliable resource that explains the process thoroughly. You can access it here.

- FAQ Section on Seamlss:

- We’ve curated a comprehensive FAQ section on our platform to address common queries and concerns regarding the Agent-Client Linking process. This section provides clear answers to frequent questions, ensuring that both firms and their clients have a reliable source of information at their fingertips. Our FAQ section is designed to simplify the understanding of the new process, offering a helpful resource for quick reference. Visit our FAQ section [here] for more insights on Agent-Client Linking.

- Feedback Loop:

- Your feedback is invaluable to us. We encourage our readers and users to share their thoughts, experiences, and queries regarding the Agent-Client Linking process. Whether it’s a question about the process, a suggestion for improving our resources, or sharing your experience on transitioning to the new system, we are here to listen. Your insights help us continuously improve and provide better support to our community. Feel free to leave your comments below or contact us directly through our Contact Us page.

Together, we can navigate through the new regulatory landscape more effectively.